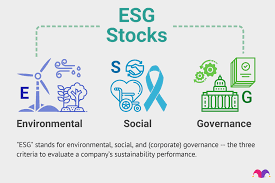

The ESG Meaning of ESG in Business

ESG meaning stands for environmental sustainability and responsible growth. It involves transparency and policies that promote ESG. Bank of America, for example, recently updated its practices and adopted more renewables businesses. They adjusted employee contracts and promoted diversity within their management teams. As of 2015, the financial services industry projects that the renewable energy sector will generate US$13 trillion in additional revenue. But how does the ESG meaning impact businesses? Here’s what you need to know.

Environmental

A growing number of global companies have realized the environmental significance of ESG in their business. The construction of sustainable buildings will not only benefit the environment, but also increase the profitability of real estate investments. To help the environment and boost returns on real estate investments, governments are encouraging innovative construction methods. Leading global companies are making these changes to reduce their carbon footprint. Read on to learn more about the environmental significance of ESG in business. Here are some reasons why.

A stronger ESG external-value proposition may reduce regulatory pressure. As the external-value proposition increases, so does the likelihood of favorable government action. Increasing ESG’s importance will boost a company’s reputation and drive market performance. Moreover, ESG is more likely to be mandatory in the future. Companies that do not integrate ESG into their DNA risk facing legal, regulatory, and reputational problems. So, organizations must work to understand the human dynamics behind the shift towards sustainability.

Social

The term ESG has two distinct meanings. The most widely known one has to do with environmental issues. But the ESG acronym has a social and governance component. The latter refers to the organisation’s relations with stakeholders, including employees, communities and the political environment. Social risks and opportunities can have an impact on financial performance and public perception of a company as a responsible corporate citizen. The social meaning of ESG is gaining in importance, and the acronym can help managers measure these factors.

ESG has three pillars. Environmental measures focus on a company’s impact on the environment and social issues focus on its internal functions. And social measures address how well a company is behaving with people and institutions. While the environmental component has dominated the ESG movement for many years, the social pillar is gaining ground, and is becoming a critical element of ESG-based investment strategies. Companies that have a good ESG proposition have a competitive advantage.

Metrics

There are many benefits to using ESG metrics for your company. Not only will it provide you with a more transparent picture of your business, it will also help build trust with stakeholders. By using data-driven decision-making, your company can improve its environmental and social performance, and improve its brand reputation. Listed below are some benefits to using ESG metrics for your company. Read on to find out how you can implement them to improve your company’s performance and engage with your stakeholders.

You can use ESG metrics for a variety of purposes, including boosting company image, measuring internal goals, and identifying potential problems. By monitoring your company’s performance against these ESG metrics, you can see what your employees and customers think of your company. You’ll be able to see how your product or service is received by employees, and this can have a positive impact on sales and revenue. ESG metrics are not limited to the corporate world, however.

Investment philosophy

An ESG investment strategy may be the best option for you if you’re interested in sustainability and reducing your impact on the environment. These investing strategies are not only about choosing a company that is environmentally friendly, but also about its service to society and the environment. ESG scores, which measure a company’s environmental, social and governance performance, provide an important metric for comparing investments. Depending on the strategy you choose, ESG investing may also increase your return on investment, as it is beneficial for all stakeholders.

As with any investment strategy, ESG requires due diligence. GPs must conduct due diligence and meet strict standards. Generally, the higher the level of ESG scores, the better. These factors may include socially responsible companies, environmentalist firms, or investors with values of social justice. GPs should choose projects that incorporate these values. In other words, ESG factors help to screen out bad companies and ensure the sustainable development of industries.

Values

In a recent study, McKinsey named cost reduction one of the five main values of ESG. Cost reduction, which is often overlooked, can have a significant impact on operating profits. If ESG is implemented effectively, a company can reduce its costs by as much as 60%. It’s important to measure these metrics along with traditional financial KPIs, such as ROE and return on investment. By incorporating ESG into their business model, companies can increase their profitability while protecting their market value and reputation.

As of August 31, the S&P 500 ESG Index had 310 constituent stocks. Ten of the largest stocks accounted for 37.1% of the index’s capitalization. These results support the idea that ESG can improve a company’s performance by improving its policies. But how does ESG compare with traditional metrics? Here are some examples. Using the S&P 500 ESG Index, we can compare companies’ performance.